Calculate my paycheck massachusetts

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52.

Massachusetts Paycheck Calculator Smartasset

Well do the math for youall you need to do is enter the applicable information on salary federal and.

. Make Your Payroll Effortless and Focus on What really Matters. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Massachusetts Hourly Paycheck Calculator.

This calculator is intended for use by US. Below are your Massachusetts salary paycheck results. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

This Massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis. The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income. Important note on the salary paycheck calculator.

Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Switch to Massachusetts hourly calculator. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator.

This income tax calculator can help estimate your average income tax rate and your take home pay. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Massachusetts State Income Tax Rates and Thresholds in 2022.

New employers pay 242 and new construction employers pay 737 for 2022. It can also be used to help fill steps 3 and 4 of a W-4 form. Employers also have to pay a Work Force Training Contribution of 0056 and a Health Insurance Contribution of 5.

Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Some states follow the federal tax year some states start on July 01 and end on Jun 30.

The calculator on this page is provided through the. Divide the sum of the two highest quarters from Step 2 by 30 the number of weeks in the combined quarters 18840 26 72461. The results are broken up into three sections.

How Your Paycheck Works. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Ad Compare 5 Best Payroll Services Find the Best Rates.

Supports by the hour salary revenue and multiple pay out frequencies. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. Our quick payroll calculator will help you physique out the federal payroll tax withholding for both your staff and your company.

This contribution rate is less because small employers are not required to pay the employer share of the medical leave contribution. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This free user friendly payroll calculator will certainly calculate your collect pay.

Similar to the tax year federal income tax rates are different from each state. If you worked 2 or fewer quarters divide the highest quarter by 13 weeks to determine your average weekly wage. Small employers are responsible for sending the funds withheld from covered individuals wages.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. The state tax year is also 12 months but it differs from state to state. In this example 72461 is your average weekly wage.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. After a few seconds you will be provided with a full breakdown of the tax you are paying.

When you join your companys health strategy you can. Details of the personal income tax rates used in the 2022 Massachusetts State Calculator are published. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437.

Your results have expired. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

Ready To Use Paycheck Calculator Excel Template Msofficegeek

What Is A Pay Stub And What Does It Need To Include Hourly Inc

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Massachusetts Paycheck Calculator Smartasset

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Ever Wonder What The Money From Your Monthly Mortgage Payment Went Toward Take A Look At This Info Mortgage Payment Home Ownership Mortgage Payment Calculator

Paycheck Calculator Salaried Employees Primepay

Take Home Pay Calculator

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

Ready To Use Paycheck Calculator Excel Template Msofficegeek

The Fascinating 4 Credit Card Payoff Spreadsheets Word Excel Templates Within Credit C Credit Card Payoff Plan Credit Card Statement Paying Off Credit Cards

Ready To Use Paycheck Calculator Excel Template Msofficegeek

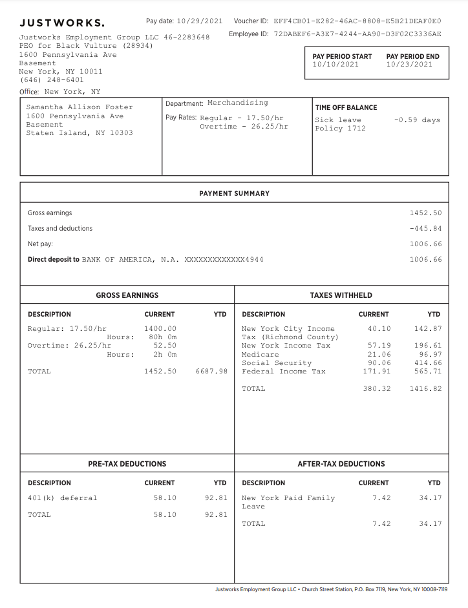

Questions About My Paycheck Justworks Help Center

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Create Pay Stubs Instantly Generate Check Stubs Form Pros